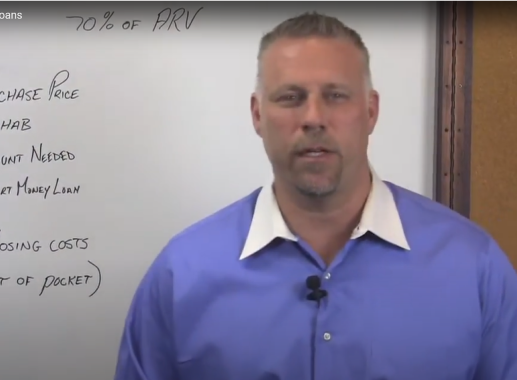

We're Real Estate Investors Ourselves

This is our background, we know what you need!

Capital Concepts is your preferred private money lender in Houston, TX. We provide the best real estate investing options in Houston, Dallas, and San Antonio, TX. Our smart lending solutions, including investing options and private lending, allow our clients to create sustainable investments that give profits in the long term.

If you’re thinking about making a sustainable investment in the real estate market, Capital Concepts can help you create these through feasible options. Our team of experts work together with each client to understand his or her needs and investment goals to get the best outcome. We provide financing for remodeling a home for resale, refinancing for long term investment, and other sustainable investment purposes. We aim to provide every client with the best tailored real estate investments in Houston, TX..